October 2025 market update

Canada Life - Nov 06, 2025

October was a month of mixed signals. While equities climbed and AI leaders like NVIDIA surged, Canada faced trade setbacks and a slowing labour market. The Bank of Canada responded with another rate cut.

Introduction

Global equity markets moved higher over October. Despite some concerns about trade, the U.S. and China reached a trade truce, while the U.S. Federal Reserve Board lowered interest rates. There were bouts of volatility as U.S.-China trade tensions temporarily escalated. The global economy demonstrated its resiliency despite trade and geopolitical tensions.

The Canadian economy continues to run at a soft pace as trade tensions with the U.S. persist. Inflation rose and the labour market continued to show signs of moderating. Canada remains without a trade deal, although negotiations were ongoing before being halted late in the month. The Bank of Canada (BoC) lowered its policy interest rate at its October meeting.

The U.S. government shut down at the beginning of October, as the two major parties were unable to reach an agreement on a new spending bill. At the crux of their disagreement was the extension of health care subsidies. With the government shutdown continuing over the entire month, several key economic indicators released by the government were delayed. At the end of October, the government shutdown was the second largest in history.

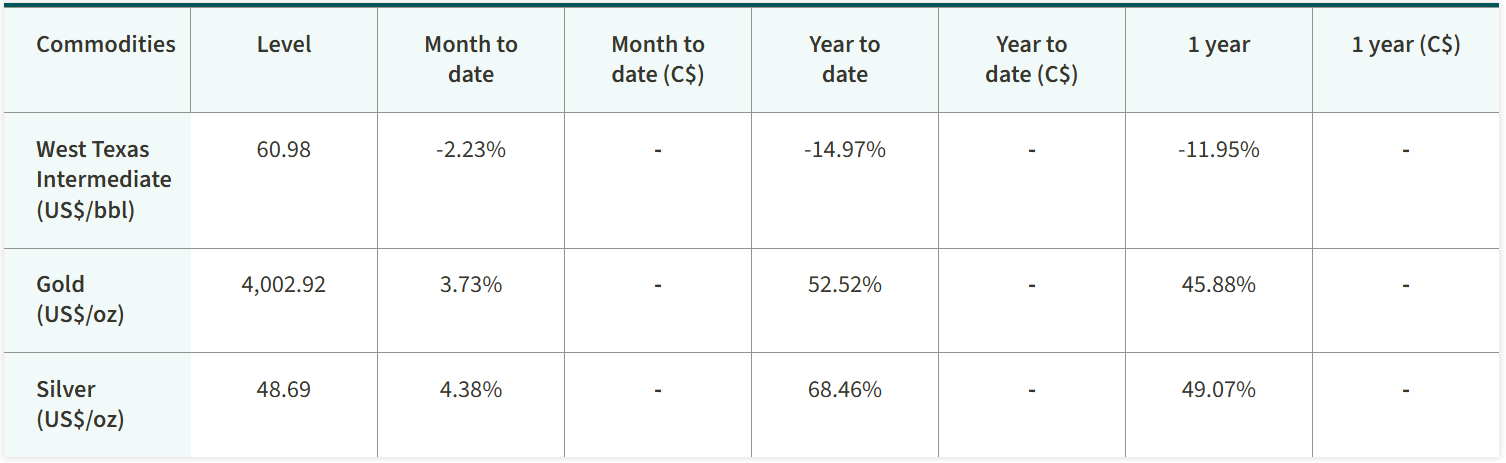

The S&P/TSX Composite Index edged higher, led by the information technology sector. U.S. equities also moved higher. Yields on 10-year government bonds in Canada and the U.S. declined. The price of gold increased over the month, reaching a new record high. The price of oil ticked lower.

U.S.-China trade talks progress despite hiccups

October turned out to be an eventful month, marked by a back-and-forth between the U.S. and China as both sought to gain leverage in trade negotiations. China announced it would impose new restrictions on rare earths exports, prompting U.S. President Donald Trump to threaten higher tariffs. However, tensions simmered as the end of the month approached. President Trump and Chinese President Xi Jinping met in South Korea, the site of the Asian Pacific Economic Cooperation summit. Both leaders agreed to a one-year tariff truce and to continue negotiations. Investors were cautiously optimistic about the announcement, recognizing that several hurdles still needed to be overcome, including those related to AI and national security threats. For now, the U.S. has lowered the tariff rate on China, while China has agreed to resume purchases of U.S. soybeans and ease restrictions on rare earth materials.

Trade negotiations were rocky for Canada. Mid-month, a report surfaced indicating that Canada and the U.S. may sign a sectoral trade deal by the end of the month. Prime Minister Mark Carney confirmed that it was a possibility. However, an advertisement quoting some of an address from former President Ronald Reagan speaking about the benefits of free trade and the harm from tariffs upset the U.S. administration. In response, President Trump halted negotiations and imposed a 10% tariff on goods not exempted under the Canada-United States-Mexico Agreement, as the advertisement had not been immediately pulled. Canada continues without a trade deal but did get some potentially good news when the U.S. Senate voted to nullify tariffs on Canada. Canada hopes to return to the negotiating table and ease tensions with the U.S., which could be a positive for consumer and business confidence, as well as the economy.

The Bank of Canada cuts rates again

The BoC lowered its benchmark overnight interest rate by 25 basis points to 2.25% at its October meeting. This marked the BoC’s second consecutive rate cut, as it seeks to provide additional support for consumers and businesses. The labour market has pulled back, raising concerns that it could dampen demand in the months to come. The payroll report from Statistics Canada (StatsCan) showed that job vacancies were at their lowest level since 2017 in August, suggesting job seekers will have a difficult time finding a job. Overall economic activity has also slowed, due to U.S. tariffs. StatsCan released a report, titled Canada’s Economy During Recent Canada-U.S. Trade Developments, which showed the impacts of trade tensions with the U.S. on the Canadian economy. To nobody’s surprise, economic growth has slowed, even falling in the second quarter, hurt by a sharp decline in exports to Canada’s largest trade partner. The report also highlighted severe weaknesses in the manufacturing sector, a critical component of Canada’s economy. The slowdown in demand and business activity has weakened the job market. Some companies have begun passing on the costs of tariffs to consumers, while almost 40% intend to do so in the next year. The BoC noted that it believes interest rates are at an appropriate level to keep inflation close to its 2% target, while still supporting consumer and business activity. The BoC holds one more meeting in 2025, but comments from this meeting suggest it may be preparing to hold rates steady. Still, much can change between now and then, particularly on the trade front.

China’s growth slowed by soft demand

China’s economy grew over the third quarter of 2025, albeit at a slower pace than the previous quarter as subdued domestic demand and a challenged property market continued to weigh on growth. The economy expanded by 4.8% year-over-year in the quarter, which topped economists’ expectations. The economy grew by 5.2% in the previous quarter. Despite the slowdown, the economy still appears on pace to meet the government’s 5% growth target this year. The economy benefited from government support measures, which were implemented to help stimulate demand and counteract deflationary pressures. Furthermore, export growth was strong over the quarter, despite tensions with the U.S. China increased shipments to other countries, which provided some support to its industrial sector. The government and the People’s Bank of China may provide even more support to try to get the economy moving in full gear again. A tariff truce with the U.S. and a potential trade deal on the horizon could also give a boost to economic activity in China.

NVIDIA reaches US$5 trillion valuation

Technology heavyweights continued to drive equity market performance as investment into the development and infrastructure of AI brightens the growth outlook for technology companies. At the forefront of the AI revolution is NVIDIA Corp. The world’s leading AI chipmaker surpassed a US$5 trillion market capitalization last week, the first ever to do so. NVIDIA is at the forefront of AI chips and has made several key investments that will help the company expand its presence in the AI space. Those investments include a stake in Nokia Oyj during October. And NVIDIA is not alone. Several other technology companies are making massive investments in AI. Late in the month, Meta Platforms Inc. announced a debt offering to help fund its investment in AI. Microsoft Corp. and OpenAI Inc. reached a deal, giving Microsoft a 27% stake in the company, which values the company at US$500 billion. The deal will also allow OpenAI to restructure itself as a for-profit corporation. Activity in the AI space has not been isolated to technology companies. A consortium led by BlackRock Inc. acquired Aligned Data Centers, which owns data centers needed for AI infrastructure. Some worry about an AI bubble forming, but NVIDIA CEO Jensen Huang tried to squash those concerns. Leading technology companies’ investment and developments in AI have helped drive their stock prices, and the overall market, higher over the past few years.

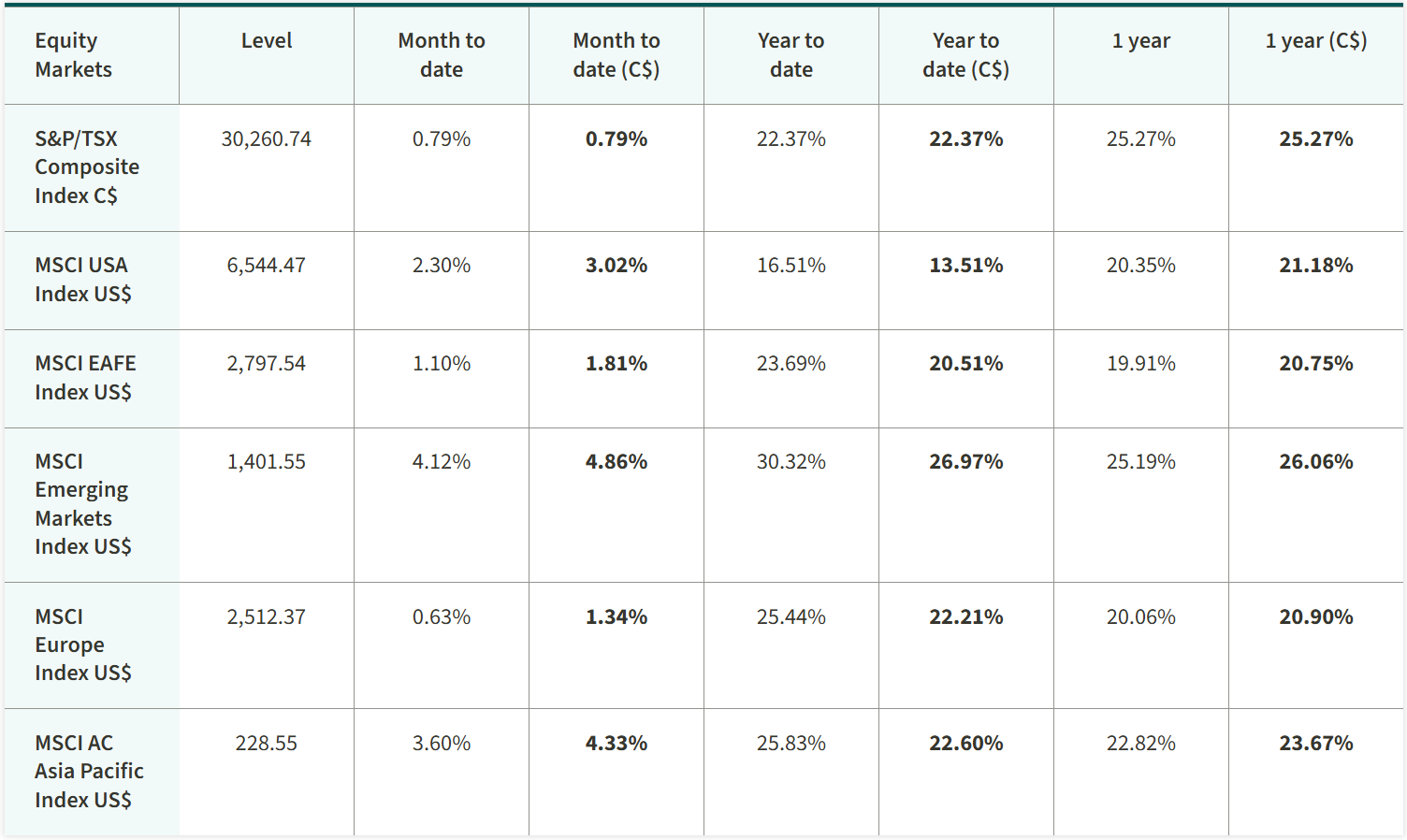

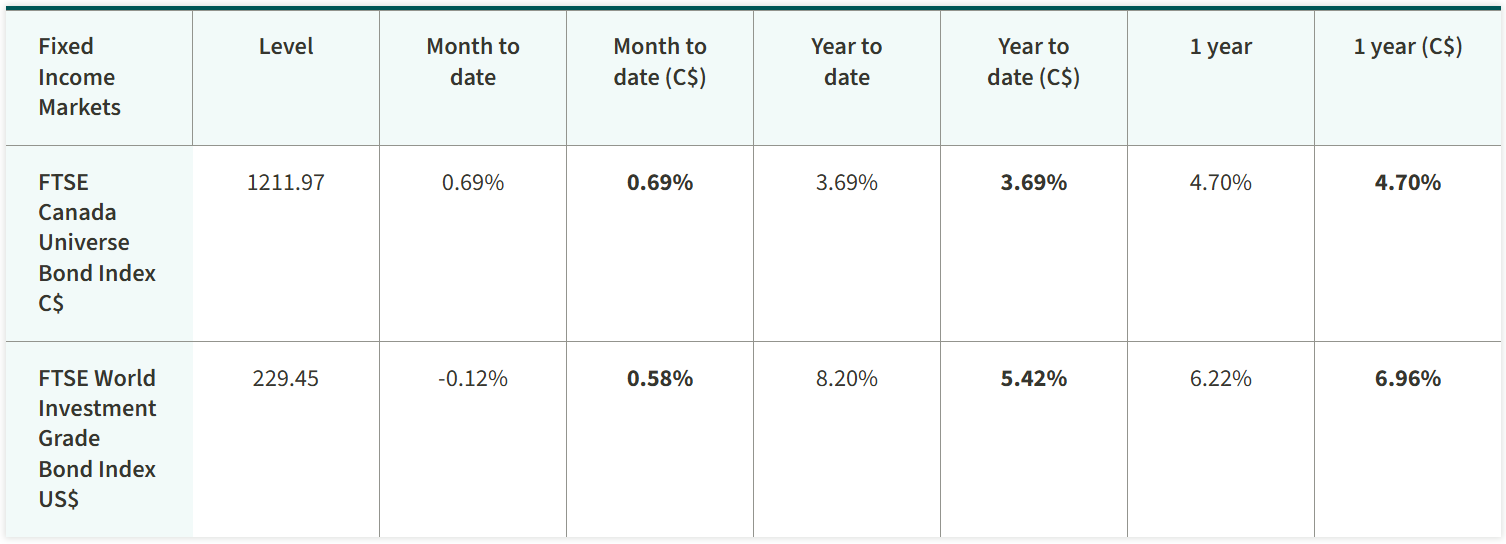

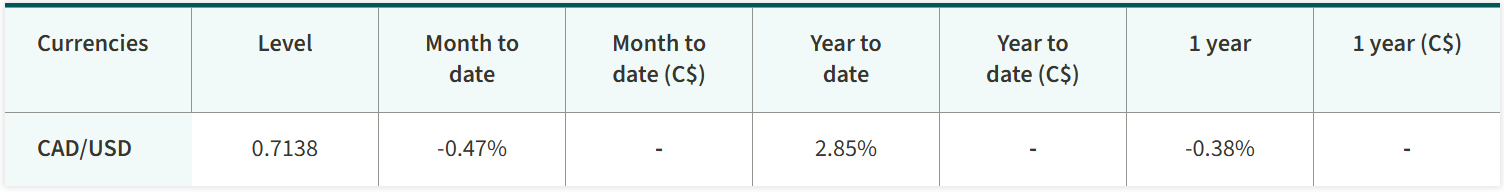

Market performance - as of October 31, 2025